If you’re asking yourself, “Can I do owner financing in Oklahoma if I still have a mortgage on the property?”, you’re not alone. Many Tulsa homeowners want to explore creative ways to sell, especially when traditional methods feel slow or limiting. The good news? Yes, you can offer owner financing—even if there’s a mortgage still in place—but you’ll need to understand the legal structure, potential risks, and how to protect yourself.

This article explains everything you need to know about how to do owner financing in Oklahoma, even when your home isn’t paid off yet.

1. What Does Owner Financing Really Mean?

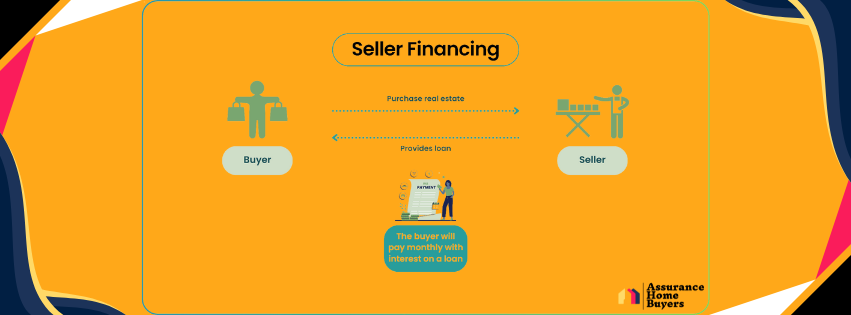

Understanding can I do owner financing in Tulsa starts with the basics. Owner financing means you, the seller, act like the bank. Instead of your buyer applying for a mortgage, they make payments directly to you. In return, you give them rights to the property, usually through a legal instrument like a promissory note.

When you still have a mortgage, this becomes what’s known as a “wraparound mortgage” or “subject-to” financing.

2. Can I Do Owner Financing in Tulsa If I Have a Mortgage?

Yes—but you must proceed carefully. If your existing mortgage has a due-on-sale clause, it means your lender could technically demand full repayment if the home is transferred to someone else (even through owner financing).

That’s why anyone considering if they can do owner financing in Oklahoma should first check with their lender or a real estate attorney. Sometimes, with the right documentation and continued payment reliability, lenders overlook these types of deals.

3. Structuring It the Right Way

If your lender permits it (or you’re willing to take the calculated risk), here’s how owner financing in Tulsa can work:

-

You continue making mortgage payments to your lender.

-

Your buyer makes monthly payments to you—typically at a higher interest rate.

-

You create a second promissory note, legally binding, to document the agreement.

-

If the buyer defaults, you regain the property through foreclosure (just like a traditional lender would).

When asking, “Can I do owner financing in Tulsa without legal headaches?”, the key is getting the paperwork right. Work with professionals who understand Oklahoma laws.

4. Advantages of Owner Financing (Even with a Mortgage)

Still unsure if you should explore this route? Here’s why many people say yes to the question, “Can I do owner financing in Tulsa?”

✅ More Buyers – You attract buyers who can’t qualify for traditional loans.

✅ Faster Sale – No waiting on bank approvals.

✅ Monthly Cash Flow – You earn interest while still holding the mortgage.

✅ Sell My House Fast Tulsa OK – Often, this is faster than listing with an agent.

✅ Sell My House As-Is in Tulsa – Buyers typically expect to make repairs themselves.

5. Protect Yourself

-

Owner financing comes with some risks, especially when there’s an existing mortgage. To protect yourself:

-

Consult a real estate attorney in Tulsa.

-

Use title companies and escrow services to handle documents and payments.

-

Get insurance and make sure taxes are current.

-

Include a forfeiture clause or a deed in lieu of foreclosure to simplify repossession if needed.

If the idea still sounds too risky, you have other options…

-

6. Alternative: Sell to Cash Home Buyers in Tulsa

If all of this sounds overwhelming, don’t worry. Another great option is selling your home directly to cash home buyers in Tulsa. At Assurance Home Buyers, we buy houses in Tulsa in as-is condition—even if there’s a mortgage—and we can close quickly.

Rather than navigating wraparound financing or legal risks, we offer a simple solution: sell my house Tulsa, fast and stress-free.

So, can I do owner financing in Oklahoma if I still have a mortgage? Yes, it’s possible. But it’s not for everyone. With the right legal support and documentation, it can be a creative way to sell your home and get cash flow.

However, if your goal is a quick, straightforward sale, Tulsa home buyers like us are ready to help. Whether you need to sell my house fast Tulsa OK or want a flexible offer without repairs, we’ve got your back.

💬 Have questions about owner financing or need to sell fast? Contact Assurance Home Buyers today—we’re your trusted cash home buyers in Tulsa ready to help you explore every option.

Get in touch with us today by clicking here to fill out the form or by calling us at (918) 205-8872.